You run a nonprofit. You provide a community service—like dance classes or arts training. You also sell merchandise to support your mission.

At tax time, many NPOs assume they are automatically entitled to the standard 50% Goods and Services Tax Rebate (commonly called the GST/HST Public Service Bodies’ Rebate).

However, CRA Guide RC4081 contains a specific regulation defined as the “Qualifying NPO” Test. If you overlook this rule, your rebate eligibility on overhead isn’t 50%. It is 0%.

Eligibility for the Goods and Services Tax Rebate

To claim the PSB rebate on exempt expenses (rent, mats, office supplies), you must be a “Qualifying Non-Profit Organization.”

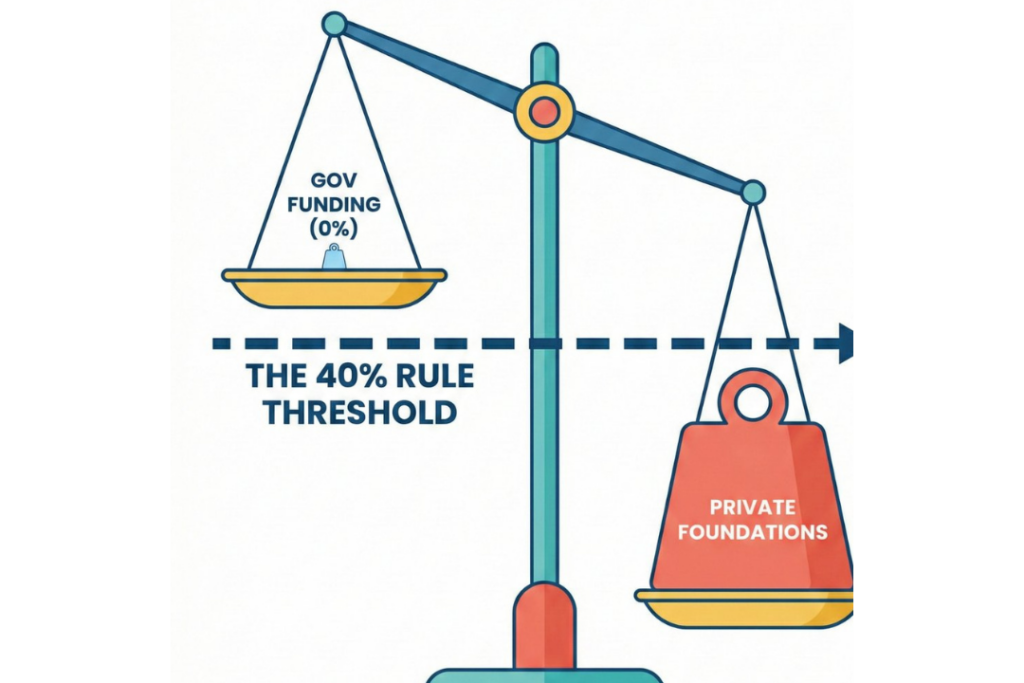

This requires that at least 40% of your total revenue comes from Government Funding.

What Counts as “Government Funding”?

The definition is specific. To meet the 40% threshold, funding must generally come from:

- Federal, Provincial, or Territorial Governments.

- Municipalities (which are also defined as public service bodies).

It creates a distinction between public funding and private sources. The following usually do not count toward the 40% threshold:

- Grants from private foundations (e.g., family or corporate foundations).

- Individual donations.

- Business sponsorships.

The Case Study:

Consider a local Dance Club that teaches kids on the first floor and sells hoodies and leggings in the lobby.

- Revenue: 30% Class Fees, 20% Hoodie sales, 50% Private Foundation grant.

- Government Funding: 0%.

Because they fall below the 40% threshold, they are not a Qualifying NPO.

The Risk: If they spend $5,000 on dance mats (an exempt activity) and claim the Goods and Services Tax Rebate, they are non-compliant. They are eligible for $0.

The Solution: The “Commercial Activity” Strategy

Here is the optimization many organizations miss. Even if you do not meet the 40% funding test, you can still recover tax on your Commercial Activities—provided you are registered for GST/HST.

Because the Dance Club sells hoodies and leggings (taxable goods), they are engaged in a commercial activity.

- Direct Cost (Merchandise): When purchasing hoodies for resale, they can claim a 100% Input Tax Credit (ITC).

- Overhead (Rent/Lights): If 20% of their facility is used for retail, they can claim 100% ITCs on 20% of the rent.

CRA Pro Tip: The CRA explicitly distinguishes between supplies used for “exempt activities” (like art lessons) and “commercial activities” (like selling art supplies). Merchandise bought for resale should be attributed exclusively to your commercial activity, allowing for a 100% ITC claim on those specific costs.

Important Note on Registration: You cannot claim Input Tax Credits unless you are formally registered for GST/HST. If you are a “Small Supplier” (under $50k revenue) and choose not to register, you cannot claim these credits.

Conclusion The rules regarding Government Funding thresholds are strict.

- If you qualify: You claim the 50% PSB Rebate on exempt costs, and 100% ITCs on commercial costs.

- If you do not: You claim 0% on exempt costs, but can still claim 100% ITCs on commercial costs (if registered).

Do not guess on your eligibility. Contact our team to have your funding sources reviewed and your GST/HST return prepared correctly.